Graduated Payment Mortgage (GPM) Calculator

This graduated payment mortgage (GPM) calculator can be employed for the computation of the first and following payments required on a GPM for a variety of mortgage terms.

What are Graduated Payment Mortgages (GPMs)?

A graduated payment mortgage (GPM) is a form of fixed-rate mortgage which begins with a low payment rate which gradually rises until a larger amount is being paid in the final stages. The monthly payments will begin low and see a gradual increase each year for between two and five years (or ten years, depending on the plan chosen) until they reach an agreed limit.

As an example, imagine you accept a graduated mortgage in which the monthly payments to begin with are $960 with two annual "graduations" at 5% each. In the first year of your mortgage you would pay $960 a month, in the second year $1008 a month, and then for the third and subsequent years you would pay $1058.40 a month. These mortgages can be useful to people who anticipate that their income will rise as the years go on.

GPM Formula and Calculation Example

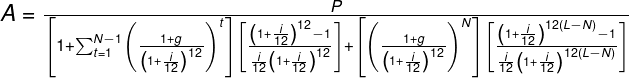

The formula below can be employed for calculation of monthly payment amounts for the mortgage's first year:

Where:

A = monthly payment amount,

P = principal amount,

L = loan term in years,

N = number of graduations in GPM,

i = annual interest rate, expressed as a decimal,

g = graduated growth rate, expressed as a decimal.

To discover what the monthly payment will be in the second year, we multiply the payment in the first year by a factor of (1 + g). For calculating monthly payments in the third year, we simply do the same process with the second year payment.

Below is an example calculation to show how GPM functions:

Imagine you assume a loan of $150,000 for 30 years, with the annual rate being 9%. You agree to graduated payment increases each year for the first five years and then a set steady payment after that, with increased rates of 7%. This gives us variables of P = 150,000, i = 0.09, M = 30, N = 5 and g = 0.07. If we put these values into our graduated payment formula we arrive at:

A = 150000 / [(4.787)(11.4341) + (0.8958)(119.2682)]

= 150000 / 161.5754

= 928.36.

In the initial year, there will be a monthly payment of $928.36. To calculate what the payments will be in the following years, we just multiply the figure for the previous year by 1.07 up to our sixth year.

Year 1: $928.36

Year 2: ($928.36)(1.07) = $993.34

Year 3: ($993.34)(1.07) = $1062.87

Year 4: ($1062.87)(1.07) = $1137.28

Year 5: ($1137.28)(1.07) = $1216.89

Years 6-30: ($1216.89)(1.07) = $1302.07

This compares with a 30 year fixed rate mortgage at 9% for which monthly payments from the start would be $1206.93 a month.

Reference: Goebel, P.R. and N.G. Miller, 1981, Handbook of Mortgage Mathematics & Financial Tables, Englewood Cliffs, N.J.: Prentice-Hall.

You may also be interested in our Mortgage Overpayment Calculator or HELOC Payment Calculator